How Much Does Legal Funding Really Cost

When you are in need of a legal funding, most often your situation requires cash sooner rather than later and therefore, you may not think you have the time to “shop” for the very best deal. However, it is important to understand how much a legal funding costs, and how the company you choose is pricing its service so you can know exactly the full extent of fees.

Legal funding companies price their services in a wide variety of different ways. Often, these different pricing structures can be confusing making it difficult to compare actual costs amongst the competition. Also, for competitive reasons, funding companies do not always publish their pricing and fees, so it would be a challenge even to know what questions to ask when researching the actual all-in costs of a legal funding. Let’s clear things up.

As you look for a legal funding company, you may be enticed by a low Annual Percentage Rate (APR), or a low multiple. However, don’t simply look at this number, as it may not provide all of the details. There can be additional fees tacked on which can make the overall cost higher.

In general, the types of fees charged by legal funding companies can include a wide range: application fees, funding delivery fees, underwriting fees, document fees, servicing fees, archiving fees, additional funding review fees, and either an interest rate and/or a multiple on the amount of the funding. When looking at that long list of additional fees, it may seem like a long list of arbitrary fee.

To be fair, not all funding companies charge all of these fees, but some do. As such, it is vitally important to get a clear picture of all of the costs associated with your pre-settlement legal funding. This can greatly impact not only the amount you’ll receive when you obtain your initial legal funding, but also any additional fundings you may receive, as well as how much you’ll have to pay back when your case settles.

The APR or Multiple – Base Pricing

Most funding companies will communicate its base pricing in one of three forms:

1) An Annual Percentage Rate (APR);

2) What is commonly referred to in the industry as a “multiple” or “multiplier,” or;

3) A combination of the two.

APR

Most people will recognize an APR as this is how mortgage lenders and credit card companies describe the amount of interest they charge on mortgage loans. The calculation is no different in the legal funding industry. If a company charges an APR, this is how they will calculate the amount that will be due when it comes time to repay the funded amount. With an APR, however, make sure to ask how often the amount is compounded (daily, monthly, etc.), and if there is a cap to how much can be charged. How often the amount is compounded will determine how fast the amount owed grows. Also, a compounding APR with no cap, can grow rapidly to an amount that is unreasonable.

Multiple

If a funding company uses a multiple, the math here is really simple. A multiple is simply how much the company will multiply the original amount funded to determine what is owed upon the settlement. For example, if the multiple is 1.25, and you receive $1,000 in funding, then the calculation is simply 1.25 x $1,000, which equals $1,250. A 1.65 multiple on the same $1,000 equals $1,650. Companies that use a multiple as their base pricing will increase the multiple over time, with the increases coming in 6-month or 12-month increments. The multiple increases because the longer that a case takes to settle, the greater the risk is of it not actually settling in favor of the plaintiff/customer. A simple example of how a multiple grows on the same $1,000 funding is:

Again, an important item to note, when reviewing this type of pricing, make sure to ask if the pricing is capped after a certain period, or if the multiple just keeps increasing over time. If there is no cap, beware. If your case drags on for years, the final amount could be more than bargained for. In cases where there is no cap, it is highly recommended to look elsewhere.

There are also some companies that will charge a combination of both an APR and a multiple. One example could be a multiple for the first 6 to 12 months, and then a switch over to an APR. Again, in these cases, ask about a cap on the final amount owed. Even if the initial multiple is small and the subsequent APR is low, if there is no cap, just like with no cap on a straight multiple, the final amount could be staggering.

All legal funding companies will charge one of the base pricing structures, and it is this pricing that will be presented to the customer when they call to apply. Don’t be fooled, however, into thinking that this may be the only amount you will owe. Make sure to ask about any and all additional fees. Again, not all companies charge additional fees, but when they do these can add up, and when combined with the base pricing, can be very expensive. When comparing the cost of different funding companies, only looking at the base pricing can be incorrect and can seem like a good deal, when in reality it is not.

Fees, Fees, and More Fees

As mentioned, there is a wide variety of fees that is sometimes added to the base pricing. This is often done so that the funding company can lower its base pricing to make it more attractive to the consumer. Fees like underwriting fees, application fees, document fees, funding delivery fees, servicing fees, archiving fees, additional funding review fees, etc., can add up quickly. In any case, you need to aware of all the potential pitfalls so that you can make an informed decision.

To be clear, none of these fees are “bad” in and of themselves, and many other businesses charge similar fees to their customers for services they provide. For example, when obtaining a mortgage you’re likely to pay an origination fee, document preparation fees, title search fees, home appraisal fees, and underwriting fees in addition to the APR. Another example would be when buying a vehicle, you’re often charged a title fee, document preparation fee, a license transfer fee, a delivery fee, and maybe even an advertising fee.

Most of the time, additional fees and expenses are not charged to the customer up front, but are tacked on to the final amount owed. Some fees are billed once, while others are added each time a particular event occurs. Below is a description of these fees, and a breakdown of when and how often they can occur.

Application Fees can run anywhere from $100, all the way up to $500, and are charged once when the customer completes the application. This fee should be disclosed up front before a customer completes his application for funding.

Origination Fees are fees charged when your case has been approved and you accept the terms of the agreement. This fee is usually charged for all the work involved to process the funding, and is often instead of other fees, like application or underwriting fees, and is essentially charged to cover those same fees, just under a different name. They can cost between $100 and $1,000.

Underwriting Fees can cost between $100 and $300, or more. These fees are usually billed the first time a customer’s case is reviewed by the company’s underwriting staff. However, if a customer requests additional funding, these fees can be billed again if the underwriter needs to review any additional activity on the case; additional medical treatment, or an offer from the defendant, are just a few examples of activity that may allow for additional money to be provided to the customer.

Funding Delivery Fees can run between $25 to over $150, and are charged to deliver the money to the customer, whether the money is delivered via check, wire transfer to a bank account, or cash transfer service like Western Union™ or Moneygram™. Often these are added each time a customer receives money.

Electronic Signature Fees are sometimes applied if the company uses an electronic signature service to make it easier for all parties to sign the documents versus requiring all parties (the customer, the attorney, and the funding company) to hand-sign the documents and fax between the funding company and law firm. These can be charged multiple times if the customer receives more than one funding on the same lawsuit, and they can run from around $10 to upwards of $40.

Servicing Fees are fees that are billed when the funding company contacts the customer’s attorney to check on the progress of the case, as is required from time to time to ensure the attorney is still representing the customer, and that the lawsuit is progressing toward a settlement or trial. The amount of these expenses can vary greatly but are most often smaller, around the $25 range. Yet, even smaller amounts can add up if the lawsuit drags on for years.

Document Management/Archiving Fees are sometimes levied by funding companies to maintain case records or to produce funding-related documents for the customer and his attorney. These are similar to fees charged by a doctor’s office when a patient requests a hardcopy of their medical records. These fees are usually not large.

Additional Funding Fees can be tacked on if the customer seeks an additional funding on the same case. Seeking a second or even a third round of funding on a single personal injury case is not uncommon, so if the company charges a fee each time a request is made or approved, at a rate of $20 to $75 for each occurrence, these can stack up.

Case Payoff Fees are the final fees charged at the time you’re ready to pay off your legal funding(s). This fee is rarely charged but it has been seen in the industry at an amount ranging from $50 all the way up to $250.

This list of the various fees covers almost everything seen across the industry, but that doesn’t mean there could be that one-off expense charged by one of the companies in the pre-settlement legal funding marketplace.

Now what? Well, reading through the list and description of how legal funding companies price their services can be a bit overwhelming. Companies may deliberately create a low base price as an attractive incentive to work with them, then tack on a bunch of fees. Most consumers don’t think about this and don’t consider the “fully loaded” price of one company’s services compared to another company that may have a higher base price, but far fewer fees.

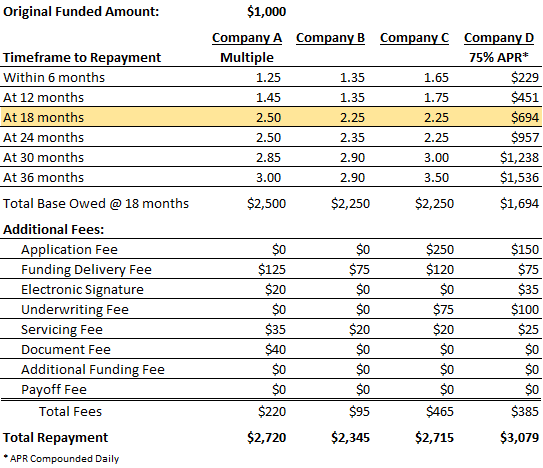

To help discern what may be really going on, below is a comparative grid illustrating four different pricing scenarios from four funding companies. It is important to note that this grid is not based on actual pricing from real-life funding companies, but it is an illustration to show you how some companies price their services with some of the fees included. This illustration will help you ask the right questions and be able to accurately compare one funding company to another before you sign any agreement.

The comparative pricing example below assumes that the original funded amount was $1,000, and the case settled after 18 months but before 24 months from the date of funding. Also, there were no additional fundings assumed on this case.

The ultimate cost of a legal funding can vary greatly especially looking beyond the initial base pricing to consider all of the additional fees that can and often are charged by the various companies in this highly competitive market. Again, not all legal funding companies charge these fees, but most charge at least a few, and when added to the base pricing can add literally hundreds of additional dollars to the final cost of the transaction. This is why it pays to be educated, to ask the right questions, and compare all of the costs before making a final decision.